The interim government’s ban on Bangladesh’s largest political party undermines democracy, empowers extremists, and threatens…

From Boom To Bust: The Collapse Of The Economy In Bangladesh Under The Interim Government

Introduction

The transition in Bangladesh after August 5, 2024, provides a stark illustration of how political upheaval can evolve from mass protests to widespread disorder, revealing the deep-seated stresses within the country and the true nature of its new interim government. Widespread protests initially emerged from student movements targeting government job quotas, but quickly snowballed into a broader national outcry against inequality, corruption, and demands for Prime Minister Sheikh Hasina’s resignation. The unrest reflected a profound dissatisfaction with the ruling party’s economic and social policies, as well as the perceived exclusion of broad segments of Bangladeshi society from meaningful power and opportunity. On August 5, 2024, the situation escalated as protesters stormed the prime minister’s official residence, prompting Sheikh Hasina to escape and resign. This sudden power vacuum laid bare the fragility of state structures, with the military stepping in to facilitate the formation of an interim government. Led by Nobel Laureate Muhammad Yunus, the new administration was formally installed on August 8, 2024.

Protest, Looting, and Costs

In the power vacuum post-5th August, Bangladesh was gripped by chaos, as demonstrators and opportunists alike engaged in looting, arson, and attacks on symbols of the previous regime. Police stations, political offices, government buildings, and private homes, especially those belonging to minority communities, were ransacked in districts across the country. Perhaps the most high-profile incident was the looting and ransacking of Sheikh Hasina’s official residence. Protesters made off with everything from furniture and electronics to livestock. In the days that followed, public pressure and campaigns by protest leaders led to a remarkable return of many stolen items, including valuable possessions, pets, and secret government files. A notable number of attacks targeted Hindu-owned homes and businesses, particularly in Khulna and Mymensingh divisions. Looting, arson, and deadly violence accompanied the broader unrest, with security forces often unable or unwilling to intervene.

In the power vacuum post-5th August, Bangladesh was gripped by chaos, as demonstrators and opportunists alike engaged in looting, arson, and attacks on symbols of the previous regime. Police stations, political offices, government buildings, and private homes, especially those belonging to minority communities, were ransacked in districts across the country. Perhaps the most high-profile incident was the looting and ransacking of Sheikh Hasina’s official residence. Protesters made off with everything from furniture and electronics to livestock. In the days that followed, public pressure and campaigns by protest leaders led to a remarkable return of many stolen items, including valuable possessions, pets, and secret government files. A notable number of attacks targeted Hindu-owned homes and businesses, particularly in Khulna and Mymensingh divisions. Looting, arson, and deadly violence accompanied the broader unrest, with security forces often unable or unwilling to intervene.

Following the political unrest and protests in Bangladesh after August 5, 2024, various sectors experienced significant damage and disruptions. The textile and garment industry faced setbacks due to political instability, floods, and a shortage of LNG.[i] Additionally, the protests led to disruptions in exports, increased costs, and factory closures. The agricultural sector, particularly in flood-prone areas, suffered damage to crops, fishponds, and infrastructure. Furthermore, the political turmoil impacted the economy, with the Asian Development Bank downgrading growth forecasts.[i]

Following the political unrest and protests in Bangladesh after August 5, 2024, various sectors experienced significant damage and disruptions. The textile and garment industry faced setbacks due to political instability, floods, and a shortage of LNG.[i] Additionally, the protests led to disruptions in exports, increased costs, and factory closures. The agricultural sector, particularly in flood-prone areas, suffered damage to crops, fishponds, and infrastructure. Furthermore, the political turmoil impacted the economy, with the Asian Development Bank downgrading growth forecasts.[i]

While there was a 2.9 per cent increase in net FDI during FY2024 compared to FY2023, the most recent months of FY2025 show a significant decline in net FDI compared to FY2024. Furthermore, if only net inflows are considered,

FDI actually declined in FY2024 as well. According to Bangladesh Bank data, net FDI inflow decreased by 8.8 per cent in FY2024 compared to that in FY2023. According to the ICT and telecommunications ministry, the sector faced financial losses of Tk 18,000 crore.[ii]

During the Yunus-led administration, deep structural challenges persist, including high youth unemployment, corruption, and sluggish industrial growth, while ongoing political uncertainty continues to discourage investment. According to World Bank estimates, an additional three million people in Bangladesh could be pushed into poverty in 2025 alone. The outlook is equally sobering on GDP growth, which is expected to slow to 3.3 percent in fiscal year 2024-25. Compounding these challenges is the looming threat of higher U.S. tariffs, which risk further pressuring Bangladesh’s export-dependent economy.

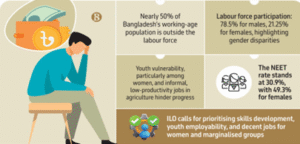

The law and order situation remained fragile, and instances of mob culture had lowered the business confidence in the country. Due to repeated labour unrest, many factories closed in the past year, which led to an increase in unemployment. According to Industrial Police data, more than 100 units closed between August 2024 and May 2025, resulting in about 60,000 workers becoming unemployed. Between July and December 2024, Bangladesh lost an estimated 2.1 million jobs, with women disproportionately affected. The apparel sector, a major export earner, faced disruptions due to factory shutdowns, internet outages, and violence, leading to negative signals for international buyers and increased costs for exporters. Moreover, various protests in the government and private sectors have undermined the investment climate and threatened operational continuity in many sectors during the interim government. A low level of foreign direct investment, a contractionary monetary policy and uncertainty over the state’s democratic transition also impacted the businesses throughout the year.

The Real Character of the Post-5th August Government

The interim government, inaugurated on August 8, 2024, faces the herculean task of restoring law and order. Its initial actions included granting immunity for actions taken during the protests (through August 8), promising thorough investigations into human rights violations, and initiating operations to curb ongoing violence. The core ambitions of the interim leaders and activists are the reform of state institutions, the establishment of a truly inclusive society, and delivering justice for the atrocities committed during the protests and crackdown. The interim government’s legitimacy is constantly tested by unrest, factionalism, and communal violence, and its authority is challenged both by remnants of the old guard and opportunistic rioters. There are concerns that, despite promises of reform and dialogue, deep-rooted corruption, impunity, and violence may persist if meaningful institutional changes do not happen. Calls for radical reforms include changes to the constitution, policing, electoral system, economic policy, and minority protections.

The transition from protest to looting and governmental instability reveals a Bangladesh both desperate for systemic reform and vulnerable to lawlessness in periods of political uncertainty. The real character of the post-5th August government is one of struggle: striving to fulfill the lofty goals of protesters, control chaos, mediate between warring factions, and deliver justice and accountability while under the constant threat that the very violence and lawlessness the protest opposed could engulf its future if reforms falter.

Real Picture of Economic collapse and slowdown of Bangladesh

Here’s a comprehensive overview of the economic and industrial disruptions linked to the Muhammad Yunus interim government in Bangladesh over the past year (since its formation on 8 August 2024**)

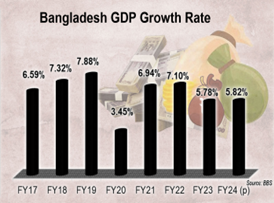

- World Bank cut its forecast from 5.7% (April 2024) to 4.0% (October 2024) for FY2024‑ [iii]

- For the July-September 2024 quarter, growth slowed sharply, with large-scale industrial production contracting by 0.71% YoY (it had previously been +11.87% a year earlier).[iv]

- Later, growth projections dropped to 3.8% and even 3.3%, the lowest in decades.[v]

- According to industry insiders, over 60% of factories were non-operational by May 2025 due to: High production costs, Gas shortages and energy instability, Rising bank loan interest rates above 16%, and Law-and-order disruptions.[vi]

- Nearly 100 garment and related factories have been permanently shut in industrial zones such as Gazipur, Narayanganj-Narsingdi, Savar, and others, impacting 60,000+ workers.[vii]

- A Reddit estimate noted 140 garment factories closed in seven months, leaving over 100,000 unemployed, with 20% of export orders shifted to competing countries.[viii]

- BTMA data shows 330,000 job losses in the industrial sector over the past year—an unprecedented high.[ix]

- NBR revenue grew only 3.24% year‑on‑year (July‑April), the slowest pace in five years.[x]

- A major NBR strike in May–June 2025 halted customs/tax services entirely, affecting international trade worth roughly Tk 2,500 crore daily.[xi]

- Government borrowing from banks surged to Tk 985.79 billion, up 60% year-over-year by April 2025, crowding out private credit.[xii]

- Non-performing loans rose to 17% of total loans (\~Tk 16.82 lakh crore) by late 2024, adding to financial strain.[xiii]

- Factory shutdowns during student protests shut down garment operations.

- Estimated losses: \$150 million daily during curfews and communication blackouts.

- Export delays, disrupted supply chains, and inflation rounded out the impact.[xiv]

- Outages lasted a week, hitting freelancers, e-commerce, ride-hailing, and small businesses hard, cutting communication and trade capacity.[xv]

Concern of Economists regarding the slowdown of the economy of Bangladesh

Observing the economic condition, mismanagement, plundering and looting of public money, some economists of Bangladesh have raised their genuine concern. Such as:

- Zahid Hussain (Former Chief Economist, World Bank Dhaka Office) warns that political uncertainty—especially street protests—is severely undermining investor confidence and disrupting daily business activity: “Standing in traffic for three to four hours a day … it breaks the economy’s knees.”[xvi] Also criticizes the FY2025–26 budget as lacking structural reforms, questioning whether revenue targets (e.g., Tk 5.64 lakh crore) are achievable. He cautions that missing targets could force spending cuts or increased borrowing.[xvii]

- Mustafizur Rahman (Distinguished Fellow, CPD) describes the current slowdown as “the lowest GDP growth in 36 years,” but argues it could reflect a needed correction rather than structural collapse.[xviii] He also highlights weak investment (capital spending contracting \~2.4%), soaring inflation (\~9.3%), rising poverty (extreme poverty up to \~9.3%), and low FDI (\~0.2% of GDP).[xix]

- Selim Raihan (DU Economics Professor & SANEM Executive Director) warns that macroeconomic slowdown stems from both domestic mismanagement and global headwinds, including investor wariness, policy inconsistency, and political instability.[xx]

- Ahsan H. Mansur (Executive Director, Policy Research Institute) forecasts default loans could surge to 25–30% of total loans and warns that implementing IMF-driven loan policies could push defaults into the equivalent of >₹5 lakh crore taka.[xxi]

- AB Mirza Azizul Islam (Economist) stresses that without political stability, exports, growth, and business confidence will continue to deteriorate.[xxii]

- Anu Muhammad** (Former Economics Professor, JU) claims that the interim government missed key opportunities to restructure the economy post-Hasina. Continues the pattern of vested-interest control, producing no meaningful results. Factory closures and unemployment are the outcome.[xxiii]

- Khondaker Golam Moazzem and CPD Survey (Nov 2024) CPD identified inflation, economic downturn, climate risk, and policy instability as top threats in the 2-year horizon (2025–26), with corruption and foreign exchange volatility among major obstacles.[xxiv]

Conclusion:

Bangladesh’s economy stands on the brink of a severe crisis. Production and investment have stagnated amid prolonged political uncertainty, rampant corruption, and a deteriorating business climate. Both local and foreign investors are increasingly hesitant to commit capital due to unpredictable policies, bureaucratic inefficiency, and the weak rule of law. The resulting slowdown threatens to undo years of economic progress, with key sectors—from garments to agriculture—facing stagnation or decline. Renowned economists have issued urgent warnings, highlighting multiple interconnected risks: political instability, which discourages long-term planning; rampant inflation, eroding purchasing power; plummeting investment, both domestic and foreign; chronic financial-sector vulnerabilities, including banking scandals and liquidity shortages; and structural policy failures, such as an unsustainable tax system and inadequate infrastructure. The consensus is unequivocal: Without immediate and decisive reforms, Bangladesh risks sliding from a temporary economic slowdown into a prolonged recession. Key measures must include restoring investor confidence through transparent governance, stabilizing the banking sector by addressing bad loans and mismanagement, and expanding the tax net to reduce reliance on regressive indirect taxes. Failure to act could deepen poverty, exacerbate unemployment, and trigger broader social unrest—jeopardizing not just the economy, but the nation’s stability as a whole.

References:

[i] Poverty in Bangladesh stages a comeback. See: https://thefinancialexpress.com.bd/views/views/poverty-in-bangladesh-stages-a-comeback.

[ii] Bangladesh’s economic outlook for 2024-25. See: https://thefinancialexpress.com.bd/views/views/bangladeshs-economic-outlook-for-2024-25.

There are no sources in the current document.

[iii] Economy of Bangladesh. See: https://en.wikipedia.org/wiki/Economy_of_Bangladesh?utm_source=chatgpt.com

[iv] Economic woes far from over, see: https://www.thedailystar.net/business/economy/news/economic-woes-far-over-3788271?utm_source=chatgpt.com.

[v]Lower revenue collection narrows fiscal space. See: https://www.reddit.com/r/bangladesh/comments/1h0t0bj?utm_source=chatgpt.com.

[vi] Industrial system on brink of collapse amid mounting pressures. See: https://www.observerbd.com/news/527837?utm_source=chatgpt.com.

[vii] Bangladesh economy stumbles amid slowing growth, factory closures. See: https://www.dhakatribune.com/bangladesh/383997/bangladesh-economy-stumbles-amid-slowing-growth?utm_source=chatgpt.com.

[viii] 140 clothing factories closed in Bangladesh in 7 months: 1 lakh unemployed, company owners fleeing the country after Hasina’s coup. See: https://www.reddit.com/r/bangladesh/comments/1jinx2z?utm_source=chatgpt.com.

[ix] Industrial system on brink of collapse amid mounting pressures. See: https://www.observerbd.com/news/527837?utm_source=chatgpt.com.

[x] https://www.observerbd.com/news/527837?utm_source=chatgpt.com.

[xi] https://www.observerbd.com/news/527837?utm_source=chatgpt.com.

[xii] https://www.observerbd.com/news/527837?utm_source=chatgpt.com.

[xiii] Economic woes far from over. See: https://www.thedailystar.net/business/economy/news/economic-woes-far-over-3788271?utm_source=chatgpt.com.

[xiv] European Investment Bank to boost funds for Bangladesh as it weathers political turmoil. See: https://apnews.com/article/fe027d93de15d52e01c1ddd68ed72fab?utm_source=chatgpt.com.

[xv] Bangladesh’s internet shutdown isolates citizens, disrupts business. See: https://www.reuters.com/world/asia-pacific/bangladeshs-internet-shutdown-isolates-citizens-disrupts-business-2024-07-26/?utm_source=chatgpt.com.

[xvi] Stalled politics, strained economy: What’s next for Bangladesh? See: https://bdnews24.com/economy/1df9d5fcfd83?utm_source=chatgpt.com.

[xvii] Economists see a lack of depth, reform vision. See: https://www.newagebd.net/post/country/266578/economists-see-lack-of-depth-reform-vision?utm_source=chatgpt.com.

[xviii] Economic slump temporary, recovery on the horizon – Professor Mustafizur Rahman. See: https://cpd.org.bd/economic-slump-temporary-recovery-on-the-horizon/?utm_source=chatgpt.com.

[xix] Ibid.

[xx] Ibid.

[xxi] Economy stuck in the quicksand of crisis. See: htthttps://en.bdpratidin.com/special/2025/01/01/26788?utm_source=chatgpt.comps://cpd.org.bd/economic-slump-temporary-recovery-on-the-horizon/?utm_source=chatgpt.com.

[xxii] https://www.dailyindustrybd.com/news/846?utm_source=chatgpt.com.

[xxiii] Bangladesh economy stumbles amid slowing growth, factory closures. See: https://www.dhakatribune.com/bangladesh/383997/bangladesh-economy-stumbles-amid-slowing-growth?utm_source=chatgpt.com.

[xxiv] CPD: Bangladesh faces 3 major economic risks in the next 2 years. See: https://www.dhakatribune.com/business/365409/cpd-bangladesh-s-economy-lags-behind-sri-lanka?utm_source=chatgpt.com.

[i] Current Challenges of the Textile and Apparel Industry in Bangladesh. See: https://www.textileindustry.net/challenges-of-textile-and-apparel-industry-in-bangladesh/.

The Authors, Professors of Universities, wish to Remain Anonymous

Comments (0)